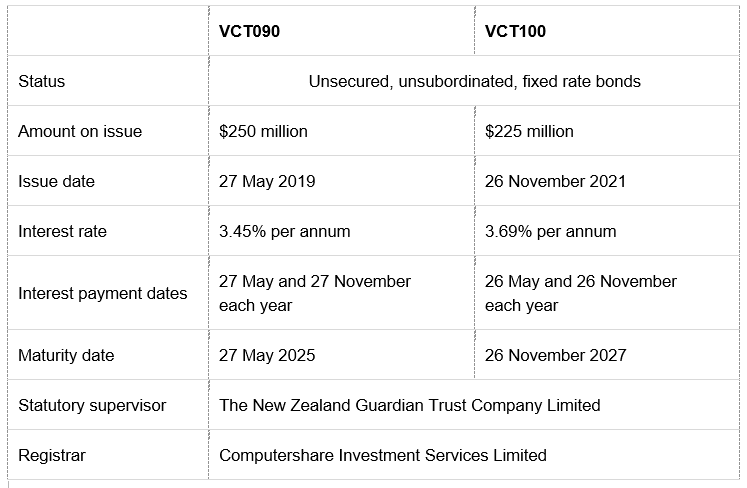

Bond Information

The fixed rate bonds referred to above are issued under a master trust deed dated 29 April 2019 (Master Trust Deed) and supplemented by series supplements dated 29 April 2019 (for VCT090) and 15 November 2021 (for VCT100) between Vector and The New Zealand Guardian Trust Company Limited.

Copies of the Master Trust Deed and the series supplements are provided below.

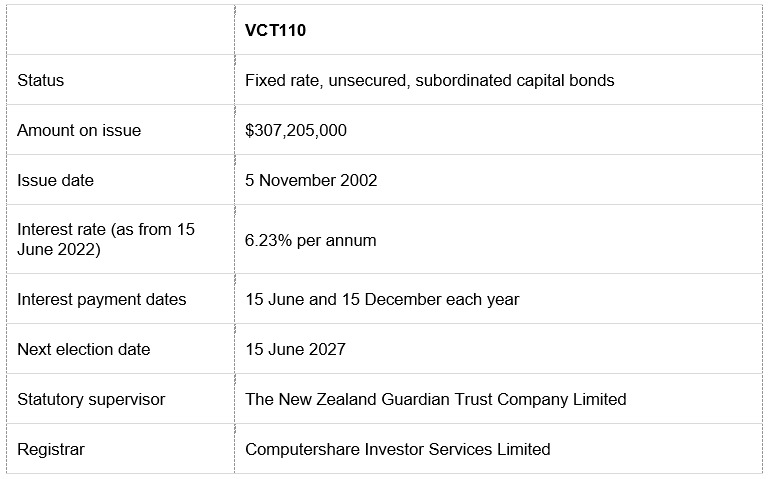

Capital Bond information

The capital bonds are issued under a trust deed dated 25 September 2002 (as amended) (

Trust Deed). The Trust Deed includes the conditions of the capital bonds set out in Schedule 1 of the Trust Deed. A copy of the Trust Deed (as amended) and the Replacement Security Deed Poll (which is also relevant to the capital bonds) are provided below.

On 3 May 2022 Vector issued an election notice specifying the new interest rate, interest payment dates and next election date to apply to the capital bonds from the election date on 15 June 2022.

The election notice can be found in the “

Market Releases” part of the “News” section of our website. Details of the new conditions are shown in the table above. The other terms of the capital bonds remained unchanged.

The next election date for the capital bonds is 15 June 2027.

Contact details for bonds

If you have any questions in relation to your bonds, you may contact Vector’s bond registrar Computershare Investors Services Limited. Computershare can be contacted as follows:

Address:

Private Bag 92119

Victoria Street West

Auckland 1142

Phone 0800 650 034 or +64 9 488 8777

Email

vector@computershare.co.nz